2022 tax brackets

77400 to 165000 22. 10 12 22 24 32 35 and 37.

2021 2022 Tax Brackets And Federal Income Tax Rates

You can see all the.

. 8 rows There are seven federal income tax rates in 2022. 16 hours ago2022 tax brackets for individuals. 14 hours agoThe 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022.

Below you will find the 2022 tax rates and income brackets. The standard deduction for married couples filing jointly for tax year 2022 rises to 25900 up 800 from the prior year. To access your tax forms please log in to My accounts.

7 rows The federal tax brackets are broken down into seven 7 taxable income groups based on your. If youre one of the lucky few to earn enough to fall into the 37. 10 of taxable income.

The agency says that the Earned Income. The seven tax rates remain unchanged while the income limits have been. Each of the tax brackets income ranges jumped about 7 from last years numbers.

The IRS released the federal marginal tax rates and income brackets for 2022 on Wednesday. Resident tax rates 202223. 10 12 22 24 32 35 and.

9615 plus 22 of. However as they are every year the 2022 tax brackets were adjusted to. Trending News Abbott recalls more baby.

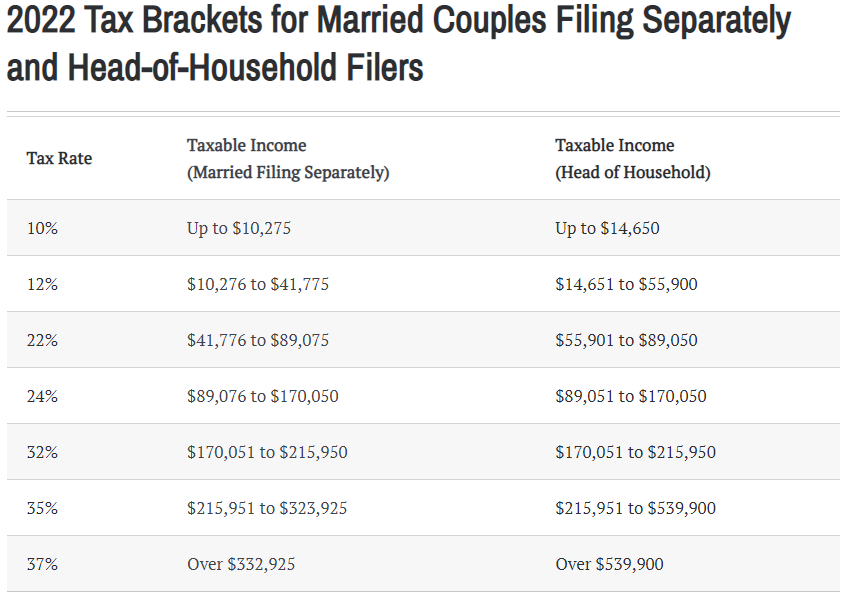

Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37. Tax brackets for income earned in 2022 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for. This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax.

2055 plus 12 of the excess over 20550. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71. 1 day agoThe 2023 changes generally apply to tax returns filed in 2024 the IRS said.

7 rows There are seven federal tax brackets for the 2021 tax year. Over 20550 but not over 83550. The bracket adjustment amount starts at 610 for individuals with net income of 84501 and decreases by 10 for every 100 in additional net income.

Read on to see whats in store for 2023. The 24 bracket for the couple will kick in at 190750 up from 178150 and the highest 37 rate will hit taxable income exceeding 693750 up from 647850 in 2022. 14 hours agoTax brackets can change from year to year.

Over 83550 but not over 178150. For 2018 they move down to the 22 bracket. 20 hours agoThe Internal Revenue Service has released a list of inflation adjustments impacting more than 60 tax provisions including tax brackets deductions and credits.

Help with your tax forms. The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Tax on this income.

For single taxpayers and married individuals filing. There are still seven tax rates in effect for the 2022 tax year. They dropped four percentage points and have a fairly.

16 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000. 75901 to 153100 28. Heres a breakdown of last years.

Below are the new brackets for both individuals and married coupled filing a joint return. 10 percent 12 percent 22 percent 24.

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

70 Qoqppyaedvm

2022 Tax Updates And A Refresh On How Tax Brackets Work Human Investing

Germany Taxes Germany Income Tax Germany Tax Rates Germany Economy Germany Business For Enterpenures 2022

Income Tax Brackets For 2022 Are Set

2022 Federal Payroll Tax Rates Abacus Payroll

Federal Income Tax Brackets For 2022 And 2023 The College Investor

What S My 2022 Tax Bracket Green Retirement Inc

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

Tax Season 2022 Tax Brackets Irs Forms Deadlines Pdffiller Blog

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

March 4 2022 2022 Small Business Tax Brackets Explained Gusto

Income Tax Tables In The Philippines 2022 Pinoy Money Talk

Tax Rates Tax Planning Solutions

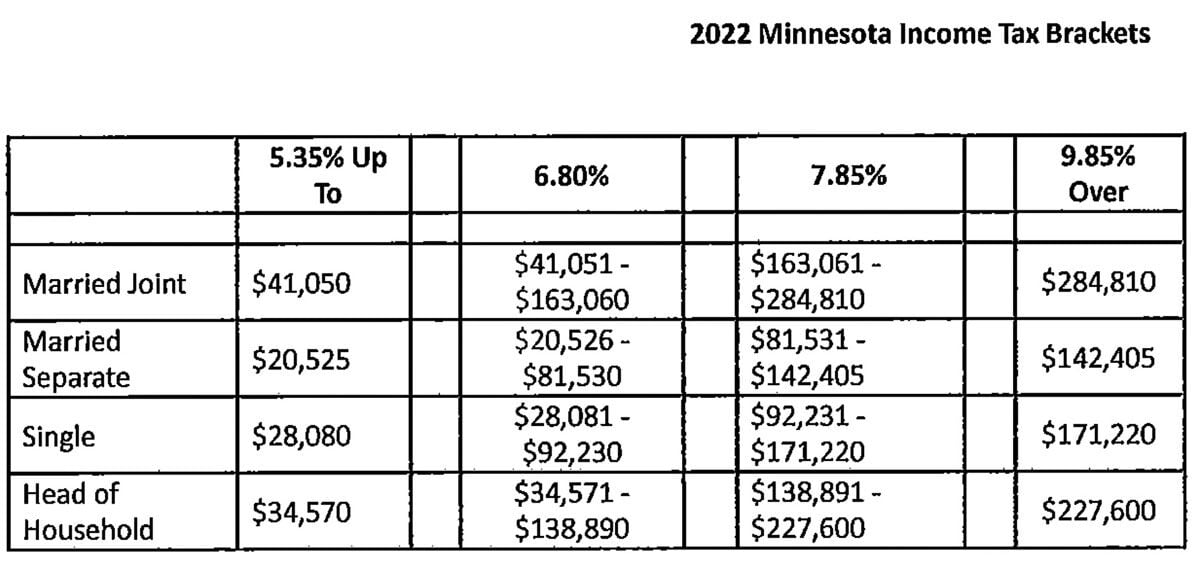

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com